PayGlocal announced the launch of Apple Pay on its international payment gateway on October 1st 2025, marking a significant leap forward in how Indian businesses can serve customers across the world.

For years, Indian merchants have been exporting innovation, craftsmanship, creativity, and services across borders. But the payment experience hasn’t always kept pace with the global quality of what’s being sold. High declines, limited payment options, and a lack of trust in cross-border transactions have often stood in the way of international growth.

PayGlocal has always been at the forefront of making cross-border payments easier for Indian exporters. Over the years, we’ve built products designed to boost payment success rates, offer more global payment options, reduce fraud, and build trust every step of the way.

Now, taking another step toward making international payments even more seamless, we’re excited to announce that Apple Pay is now available on our international payment gateway helping Indian exporters reach customers across the world with ease.

The launch of Apple pay on International Payment Gateway is PayGlocal’s step towards the change.

By enabling Indian merchants to accept Apple Pay for international card payments, PayGlocal has made it easier than ever for global customers to pay with trust, and for Indian businesses to deliver a checkout experience that feels truly borderless.

Why Apple Pay on International Payment Gateway matters

Apple Pay is one of the world’s most trusted and widely used digital wallets, available in over 80 countries. It brings together speed, security, and convenience, all while ensuring a seamless checkout experience across devices.

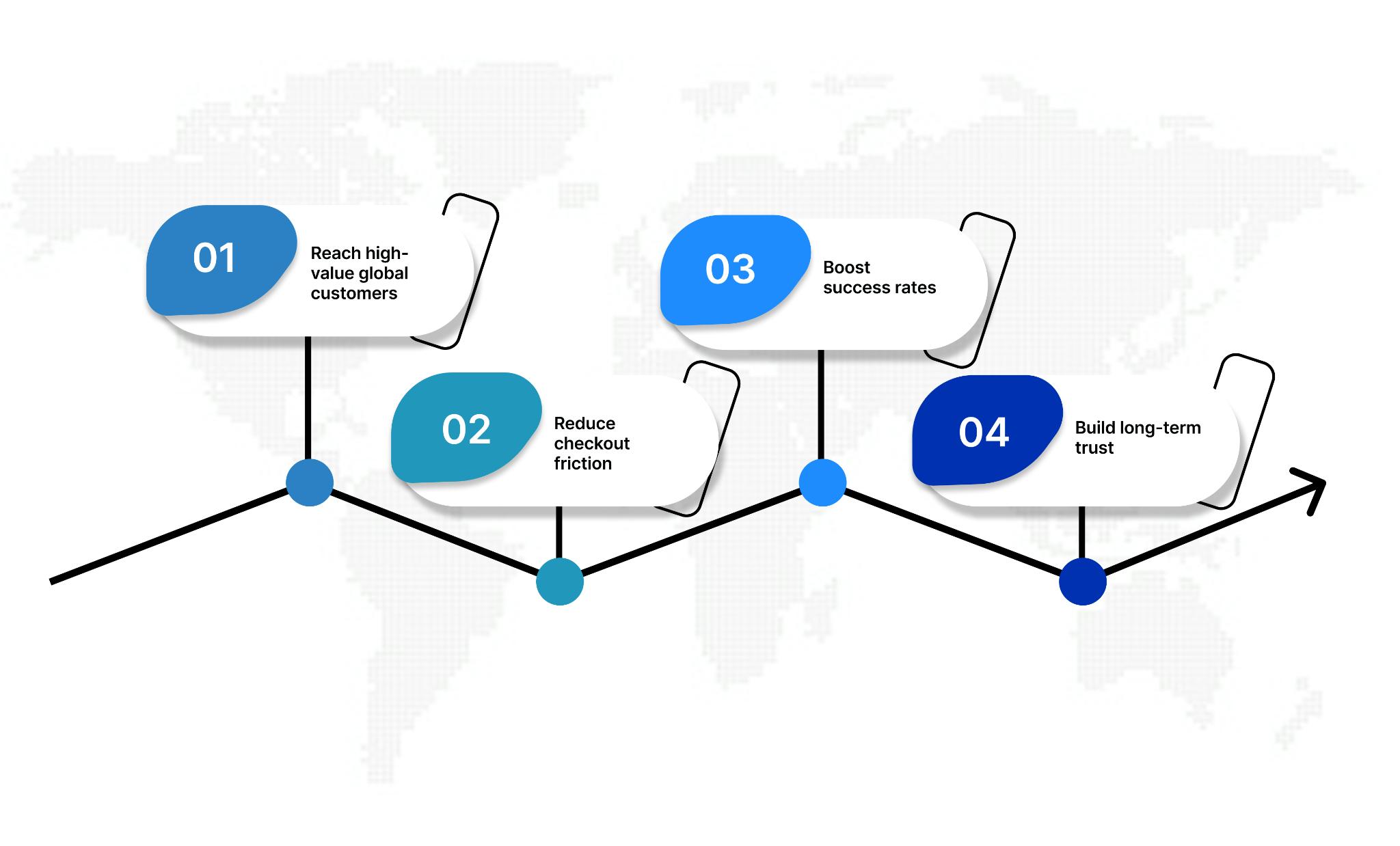

When integrated with PayGlocal’s International Payment Gateway, Apple Pay empowers Indian merchants to:

Reach high-value global customers who prefer Apple Pay for its speed and simplicity.

Reduce checkout friction with a one-tap, password-free experience.

Boost success rates through tokenized, issuer-verified transactions that minimize declines.

Build long-term trust by offering payment methods customers already rely on.

The result? A payment experience that matches global expectations, while strengthening India’s reputation as a world-class destination for cross-border commerce.

A turning point for Indian merchants going global

Cross-border commerce is no longer an edge strategy. From SaaS companies and D2C brands to travel platforms and exporters, businesses today operate in an ecosystem where customers could come from anywhere.

Yet, international card payments have historically faced challenges:

High decline ratesdue to fraud controls and inconsistent authentication.

Checkout drop-offsfrom unfamiliar payment flows.

Limited wallet acceptance,especially from premium customers who prefer local or secure digital methods.

By integrating Apple Pay, PayGlocal bridges these gaps, giving Indian merchants a powerful way to compete and convert on the global stage.

As RBI-licensed and PCI DSS-compliant, PayGlocal already enables merchants to accept and process international card payments directly on their websites and apps. Now, with Apple Pay added to the mix, those same merchants can provide a truly native, secure, and frictionless experience for every Apple Pay user worldwide.

What makes Apple Pay on PayGlocal different

Most payment gateways enable online transactions. But PayGlocal’s approach is built for global trust, combining local compliance, international interoperability, and real-time fraud intelligence.

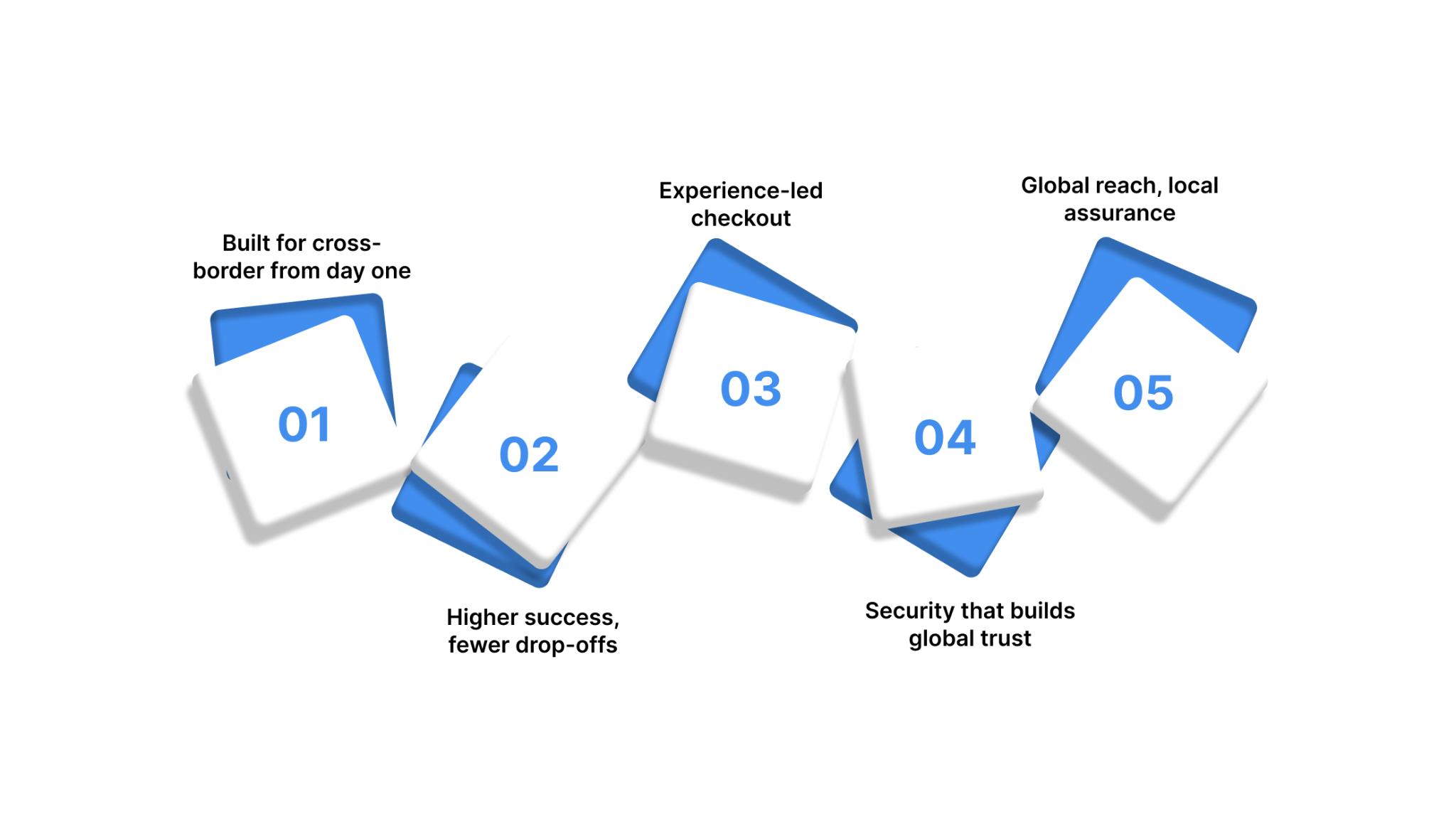

Adding Apple Pay to this ecosystem strengthens five key pillars that define cross-border payments.

Built for cross-border from day one

PayGlocal manages the entire Apple Pay flow, from compliance and authentication to settlement, ensuring merchants can go live globally with minimal effort.

Higher success, fewer drop-offs

Apple Pay transactions come with built-in security and authentication signals that improve authorization rates. Customers also see a payment method they recognize and trust, leading to lower cart abandonment.

Experience-led checkout

Apple Pay offers one-tap payments major Apple devices and browsers. For customers, it means no more manual card entry or authentication fatigue. For merchants, it translates to higher success rates and faster checkouts, especially on mobile-first journeys.

Security that builds global trust

Apple Pay never shares actual card numbers with merchants. Instead, it uses unique device-specific tokens and Face ID or Touch ID authentication to secure every transaction. Combined with PayGlocal’s fraud prevention and risk intelligence, merchants can process global payments confidently, without compromising on security or compliance.

Global reach, local assurance

Over 500Mn people worldwide, use Apple Pay. For merchants targeting customers in the US, UK, Europe, or Asia-Pacific, Apple Pay provides instant access to millions of high-value users. And because the entire transaction flow runs through PayGlocal’s RBI-approved infrastructure, businesses stay fully compliant with Indian and international regulations.

How to enable Apple Pay on PayGlocal International Payment Gateway

Getting started with Apple Pay on PayGlocal is effortless.

There’s no waitlist, no form filling, and no extra integration.

If you’re an existing merchant using PayGlocal’s International Payment Gateway hosted checkout experience, Apple Pay is already enabled on your checkout.

For new merchants, Apple Pay comes enabled by default as part of your cross-border payments setup, so you can start accepting global payments via Apple Pay from day one.

No additional steps, no separate onboarding, and no jumping through multiple hoops to reach your global customers. Just a smoother, faster checkout experience for your customers.

Apple Pay: now part of a larger cross-border ecosystem

The launch of Apple Pay integration is another step in PayGlocal’s mission to make global payments as easy and reliable as local ones.

Over the years, PayGlocal has built an enterprise-grade cross-border payments infrastructure that supports:

120+ currencies and 40+ payment methods

Advanced fraud prevention and compliance automation

99.99% uptime and intelligent routing for higher success rates

From exporters and education platforms to travel portals and SaaS businesses, thousands of merchants already rely on PayGlocal to power their international transactions.

With Apple Pay now available, they can offer their global customers a payment experience that matches their brand promise.