What is e-BRC?

In global trade, Indian exporters must navigate complex regulations, with the Bank Realization Certificate (BRC) being a key requirement. The BRC, issued by banks, confirms the receipt of foreign currency for exports, ensuring compliance with India's trade policies. It also allows exporters to claim benefits from trade organizations.

The electronic BRC (eBRC) has replaced the traditional paper certificate with a shift towards digital processes. This digital version offers faster processing, less paperwork, and greater efficiency, making it an essential tool for modern exporters. It's a digital proof issued by banks, it streamlines export documentation by eliminating physical paperwork, ensuring regulatory compliance, and facilitating faster incentive claims through direct reporting to DGFT. It also enhances financial planning with real-time payment tracking and simplifies audits with easy digital record retrieval.

In this article, we'll guide you on how to download and print your e-BRC certificate online, helping you access your BRC details without any hassle.

For more information, check out https://www.dgft.gov.in/CP/#

An e-BRC (Electronic Bank Realization Certificate) is an essential document for businesses involved in international exports. Holding an e-BRC certificate brings several key benefits: ensuring regulatory compliance, unlocking access to export incentives, boosting financial credibility, simplifying documentation, supporting trade finance, and enhancing transparency. For exporters, it is a vital tool for streamlining international trade operations and ensuring efficient financial transactions.

Below, we explore the advantages of having an e-BRC certificate in detail:

Advantages of having an e-BRC Certificate:

Regulatory Compliance:

The e-BRC certificate ensures compliance with the Foreign Exchange Management Act (FEMA) and other regulatory frameworks set by the Reserve Bank of India (RBI). By possessing this certificate, businesses can demonstrate adherence to legal requirements, avoiding potential legal implications or penalties.

Facilitates Export Incentives:

Many export incentives and benefits, such as Duty Drawback and Export Promotion Capital Goods (EPCG) scheme benefits, are contingent upon the receipt of export proceeds. An e-BRC certificate acts as proof of realization, enabling businesses to claim these incentives and boost their profitability.

Enhances Financial Credibility:

Having an e-BRC certificate enhances a company's financial credibility by validating its international transactions. This can be beneficial when negotiating with banks for loans or credit, as it provides evidence of legitimate export earnings.

Streamlines Documentation Process:

The digital nature of the e-BRC certificate simplifies and accelerates the documentation process. It reduces the need for physical paperwork, minimizes errors, and speeds up the verification process with authorities, ensuring smoother business operations.

Facilitates Trade Finance:

The e-BRC certificate plays a vital role in securing trade finance from financial institutions. It serves as documentary proof of export proceeds, which is often required for obtaining export financing and improving cash flow.

Improves Transparency:

As an electronic document, the e-BRC provides a transparent and easily accessible record of export transactions. This transparency helps in maintaining accurate financial records and simplifies auditing processes.

Image depicts the webpage of DGFT with various services available. For the user’s better understanding DGFT provides a sitemap with important vocabulary often used on this portal.

Read more here https://www.dgft.gov.in/CP/?opt=complaintssuggestion#

Here is a detailed guide on how to generate your eBRC online through DGFT portal:

Detailed Guide to Generating eBRC Online

Access the DGFT Portal:

- Visit the DGFT Official website

Log In to the DGFT System:

- Click on the "Login" option.

- Enter your credentials to access the DGFT system. If you do not have an account, you will need to register.

Image depicts the login/Register screen prompted to user on DGFT portal in order to avail any services.

Navigate to the eBRC Section:

- Once logged in, go to the "Services" tab.

- Select "eBRC Generation" from the drop-down menu.

Select the Appropriate Option:

- Choose the option relevant to your requirement, such as "Generate eBRC" or "View eBRC Status."

Fill in Required Details:

- Enter details such as the Exporter Code, Bank Name, Branch, and relevant export transaction details.

- Ensure all fields are accurately filled to avoid errors in the eBRC.

Upload Supporting Documents:

- Attach up-to-date export documentation as required by the DGFT system.

- Documentation includes Business name and address proof, Importer Exporter Code (IEC), export transactions, Bank account details based on the export invoices, Electronic Foreign Inward Remittance Certificate (eFIRC).

Submit the Request:

- Review the information you have provided.

- Click on the "Submit" button to send your eBRC generation request to DGFT.

Track the Status:

- After submission, you can track the status of your eBRC request.

- Go back to the "eBRC Generation" section and select "Track Status" to see updates on your request.

Verify eBRC Details:

- Ensure that all BRC details entered are correct and are supported by proper documentation.

- If there are any discrepancies, contact DGFT support for resolution.

Once you are able to generate and view the eBRC online, you can download and print it following the below quick guide:

Step-by-Step Guide to Download and Print eBRC Online

Login to the DGFT Portal:

- Begin by visiting the DGFT website. Use your credentials to log in. If you're a first-time user, you'll need to register and create an account before proceeding.

Access My Dashboard and Select Repositories:

- Once logged in, head over to "My Dashboard." Here, you'll find several options; select "Repositories" to proceed.

Go to Bills Repositories and Select Bank Realisations (e-BRC):

- Inside the repositories section, navigate to the "Bills Repositories" tab. From the drop-down menu, choose "Bank Realisations (e-BRC)."

Specify the Date Range and Submit the Request:

- To retrieve your e-BRC, enter the date range for which you need the certificate. After filling in the dates, click "Submit" to generate your e-BRC.

Download the e-BRC Certificate:

- Once your request is processed, the e-BRC will be available for download. Simply click on the download link to save the certificate to your device.

Now that you've learnt the download process, let's look at how you can print these important certificates effortlessly:

Search for the Required e-BRC:

- Another approach is to use the search filters to find the specific e-BRC you need. You can search by date, bank, or other relevant criteria.

Click on Print e-BRC to Print the Certificate:

- Once you've located the correct e-BRC, click on the "Print e-BRC" button. This will open a print dialog, allowing you to print the certificate directly from your browser.

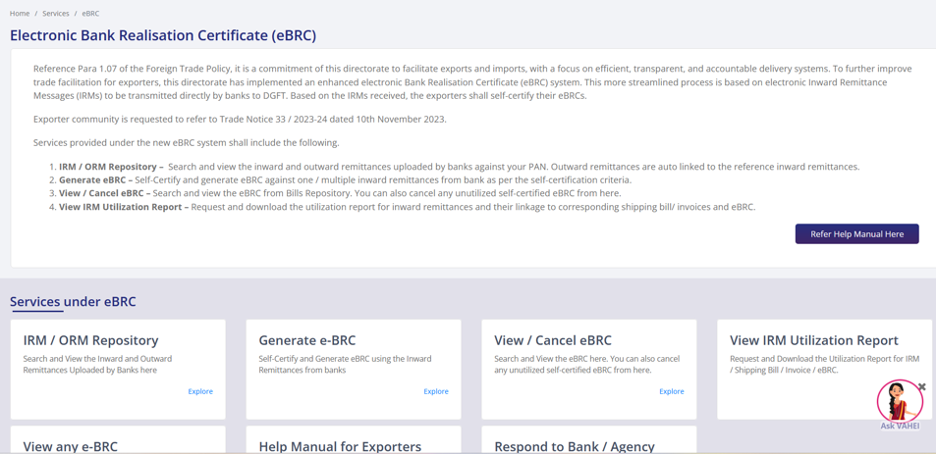

Image depicts various eBRC services available on DGFT site: https://www.dgft.gov.in/CP/?opt=services

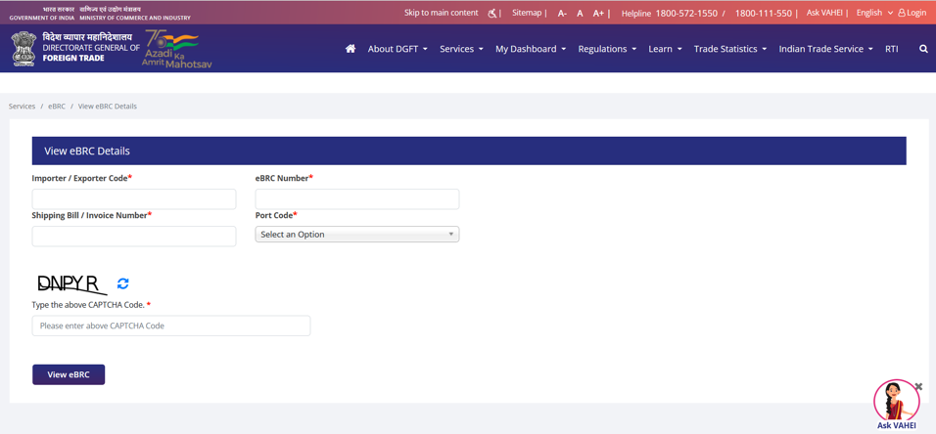

Image depicts the web page used to view eBRC online https://www.dgft.gov.in/CP/?opt=services

However, there are some common issues you may encounter while accessing your eBRC details, listed below.

Common Issues and Troubleshooting in Downloading and Printing e-BRC

Pic depicts the page you can refer to for any assistance and FAQs.

Click here for more information https://www.dgft.gov.in/CP/?opt=complaintssuggestion

Login Problems and Solutions:

- If you're having trouble logging in, ensure your credentials are correct. Clear your browser cache or try using a different browser if problems persist. If you've forgotten your password, use the "Forgot Password" option to reset it.

Issues with Searching and Viewing e-BRC:

- If you're unable to locate your e-BRC, double-check the date range or other search criteria. Ensure your bank has uploaded the details, as delays can sometimes occur.

Troubles with Downloading or Printing the e-BRC:

- If the download or print option isn't working, check your internet connection or try again after clearing your browser cache. Ensure pop-ups are allowed, as some settings may block the download window.

Contacting Support for Assistance:

- If none of the troubleshooting steps work, reach out to DGFT's support team. They can assist with technical issues or any discrepancies in your e-BRC details.

Ready to download and print your e-BRC? Follow our guide to access your BRC details quickly and efficiently. If you encounter any issues, don't hesitate to reach out for support—ensuring your export transactions are seamlessly documented is just a click away!

Conclusion

Downloading and printing your e-BRC certificate is a straightforward process once you're familiar with the steps. This document is vital for ensuring your export transactions are properly recorded and verified. By following the steps outlined above, you can easily access your BRC details, ensuring smooth operations in your export business.

For more information related to the significance of eBRC, also read: Unraveling the Significance of Bank Realization Certificate (BRC) for Indian Exporters