Nostro and Vostro accounts are terms commonly used in international banking to describe accounts that financial institutions hold with each other to facilitate cross-border transactions. Nostro accounts enable a bank to manage its foreign assets, while Vostro accounts allow a bank to provide services and facilitate transactions for its clients in foreign countries. These accounts play a crucial role in international trade and finance by simplifying the settlement of transactions and reducing the need for complex arrangements when dealing with different currencies.

Nostro Account

"Nostro" is derived from the Latin word for "ours" and it refers to an account that a bank holds on its own behalf in a foreign bank, typically denominated in the local currency of that foreign bank. The financial institution holding the account is commonly known as the "facilitator" or "correspondent" bank, while the bank that owns the account is referred to as the "respondent" bank. For instance, if a Canadian bank establishes an account with a Japanese bank to handle transactions in yen, the Canadian bank views this as a Nostro account held in Japan, allowing it to conduct business seamlessly and manage its Japanese currency holdings effectively. Here the Japanese bank acts as the facilitator or correspondent bank.

Nostro accounts make cross-border transactions smoother by holding money in a foreign bank's currency. This eliminates the need for frequent currency conversions, simplifying settlement processes and shielding banks from exchange rate fluctuations. Additionally, Nostro accounts enhance liquidity management by strategically placing funds to meet the demands of international trade

Vostro Account

On the other hand, "Vostro" is also derived from Latin, meaning "yours," and it represents an account that a bank holds on behalf of a foreign bank, in its local currency. These accounts form a crucial component of correspondent banking, where the bank holding the funds serves as a custodian or overseer for the account of a foreign counterpart. To illustrate, if a Japanese bank approaches a Canadian bank to oversee funds on its behalf in Canadian Dollars, the account is recognized by the holding bank (the Canadian bank) as a Vostro account of the Japanese bank The Vostro account arrangement allows the Japanese bank to efficiently manage funds in Canada without the need for establishing a direct presence.

Vostro accounts simplify international transactions by allowing a foreign bank to hold funds in the local currency on behalf of another bank. This setup streamlines the process for the bank's clients, reducing complexities in managing accounts across different countries. It also aids in efficient fund custody, as the foreign bank takes care of the funds on behalf of the owning bank. Overall, Vostro accounts contribute to smoother cross-border financial operations and ease of managing funds internationally.

It's all a matter of perspective.

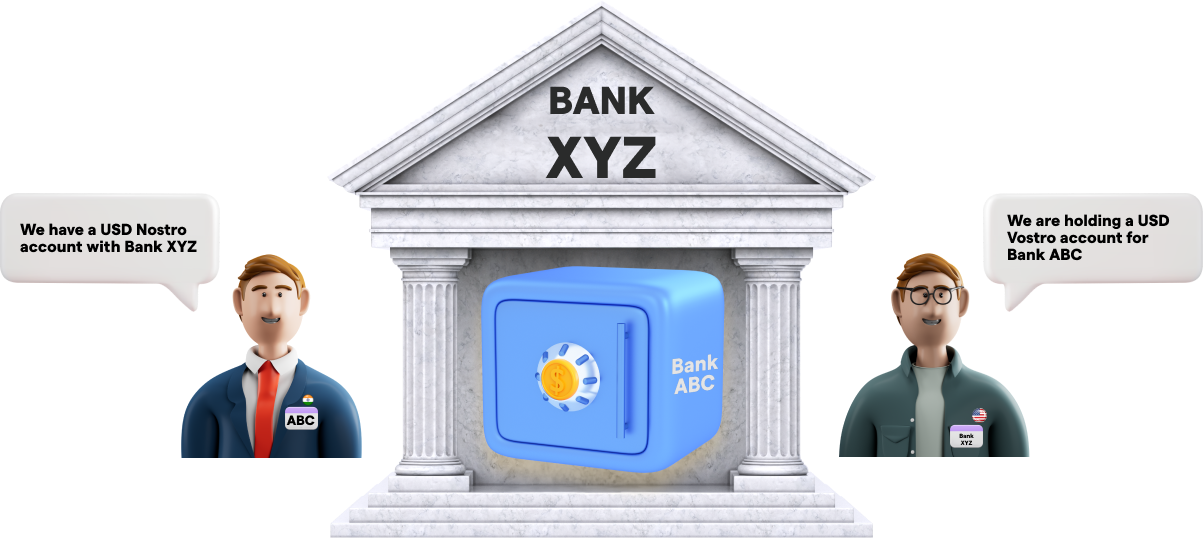

Despite having different definitions, the terms Nostro and Vostro accounts can describe the same account depending on the perspective. Let's consider Bank ABC, an Indian bank, and Bank XYZ, an American bank. If Bank ABC holds an account with Bank XYZ in USD (Bank XYZ's local currency), from Bank ABC's viewpoint, it is a Nostro account, signifying "our account on your books." This is because it represents an account held by a foreign bank on behalf of Bank ABC in a foreign currency. On the other hand, from Bank XYZ's perspective, the same account is a Vostro account, meaning "your account on our books." This is because it is holding the account of a foreign bank (from Bank XYZ's viewpoint) in Bank XYZ's local currency.

Cross-Border payments using Nostro Vostro accounts

Nostro and Vostro accounts play a crucial role in international payments, as illustrated by a simplified example involving Kiran in India and Jill in the US. Kiran, with an account at Indian Bank ABC, wishes to transfer $100 to Jill, who banks with American Bank XYZ. Indian Bank ABC maintains a Nostro Account in USD with Bank XYZ. Also Bank ABC maintains a Vostro account in INR for Bank XYZ. Upon receiving payment instructions from Kiran, Bank ABC deducts the equivalent INR amount of $100, minus any fees, from Kiran's account and transfers it to Bank XYZ's Vostro Account. Subsequently, an instruction is dispatched to Bank XYZ to transfer $100, minus any fees, from Bank ABC's Nostro account to Jill's account with Bank XYZ. Reconciliation occurs between Bank ABC and Bank XYZ to ensure the accurate and smooth completion of the international payment.

Conclusion

In conclusion, Nostro and Vostro accounts serve as a vital and inconspicuous framework for banks and large corporations, ensuring the smooth execution of international and foreign exchange transactions. This specialized system facilitates the settlement of global trades and payments without the necessity for physical establishment in a new country. Consequently, it empowers banks to extend their global presence, provide services in diverse currencies, minimize transaction expenses, manage currency risks effectively, and offer convenient access to local banking infrastructure and services in foreign markets