Global Fintech Fest 2022 brought together the regulators, banks, innovators and investors under one roof. It was an amazing platform that sparked open conversations and a new round of debates and ideas for Indian Fintech.

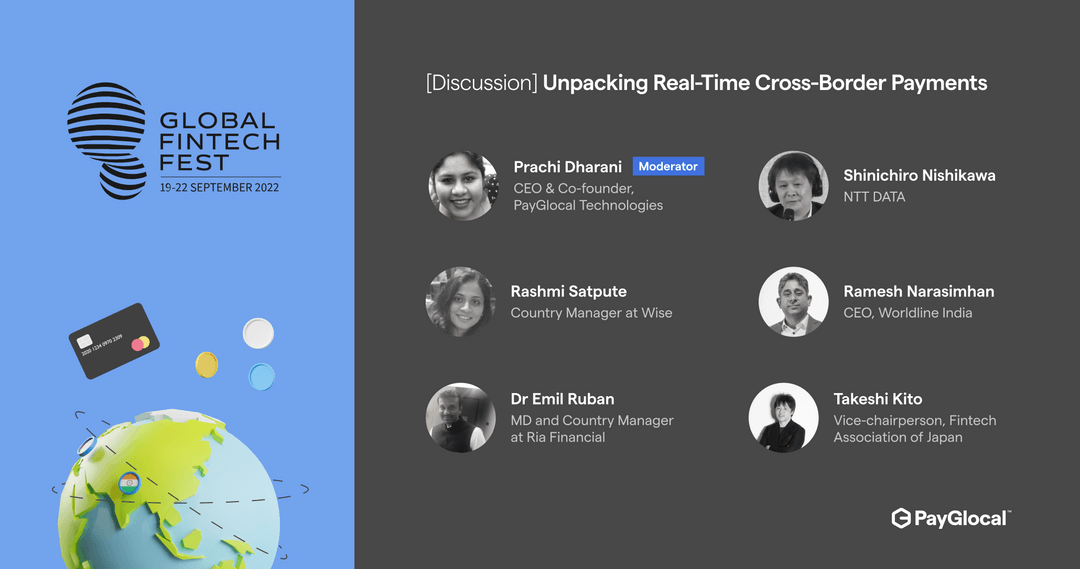

I also had the opportunity to moderate a riveting discussion on the evolution and future of real-time payments for cross-border with some of the leading minds in the space.

The growth of cross-border payments in India

Cross-border payments in India booming. Ramesh Narasimhan, the CEO of Worldline India, attributes it to main reasons:

Emergence of India as a market for global companies:

If you have a requirement you’re willing to pay for, India is the place to go. With an educated workforce and a demographic younger than 45 years of age, we’re bringing overseas business to the country

The country’s focus on exporting and global commerce:

India’s $670 billion exports in 2021-22 puts us among the top 10 exporters in the world. We also hit record exports of exported $250 billion worth of services. Our merchandise export touched $37.9 billion in June 2022 recording highest ever. Rashmi Satpute, Country Manager of Wise adds that the uptick of cross-border is not just limited to exporters or merchants, rather, businesses and financial services are joining the fray. Wise whose infrastructure includes 67 licenses in around 44 countries, is becoming the network of choice of payment infrastructure

Rashmi Satpute, Country Manager of Wise adds that the uptick of cross-border is not just limited to exporters or merchants, rather, businesses and financial services are joining the fray. Wise whose infrastructure includes 67 licenses in around 44 countries, is becoming the network of choice of payment infrastructure

Local payment methods to change the game

The payments component of this equation is that overseas merchants offer local payment methods such as UPI, and net banking, which expands the market when compared if the payments were restricted to international credit or debit cards.

Similarly, Indian exporters can do the same. Payment companies offer end-to-end services – authorization, settlement, and repatriation of funds in the currencies of their choice. We’re seeing huge traction in cross-border payments in verticals like education, travel and hospitality, OTT, airlines, SaaS.

Real time payments for cross-border

Dr. Emil Ruban talks about the evolution of payments in the last 10 years. One had to wait for 30 days to receive money in their bank account, we are now talking 30 seconds and less. Ria took advantage of this opportunity.

Ria was in the remittances space, but over the last five years, the organization built the infrastructure to connect 190 countries with 103 currencies. Today, about 40 countries in the world already provide real-time payments. With more and more transactions moving to real-time payments, it is only a matter of time before cross-border payments also move to real-time as the norm.

Shinichiro Nishikawa of NTT Data shares that collaborations and direct connections are the way forward here. The entire Asia region is moving towards RTP, he added. Singapore’s PayNow is planning to connect with NPCI. Cross-border payments via card scheme is easy. Fintech companies like NTT Data are also looking to add more localized payment methods, especially for Asian countries.

Cross-border payments in India – a global perspective

Takeshi comments that India has a growing market and a huge population. Comparatively, Japan is a fraction of it, with an aging population. Japan is working with Indian partners to bridge the gap between the Japanese payments to financial infrastructure and to the Indian one. He also talks about the need for international regulation in cross-border payments and creating a framework for it.

The way forward

The panel discusses the future of cross-border from both product and regulatory perspectives to make it more seamless transactions.

What customers expect from cross-border payments

Rashmi talks about customer’s expectations from cross-border:

- Real-time: With domestic transactions being real time, customers expect cross border also to head there soon.

- Pricing: Sending a cross-border payment should be as easy as sending an email and just as cheap. Wise envisions achieving this through their Mission Zero.

- Transparency: There are a lot of checks and a lot of layers to cross-border payments right now. customers should know what they’re paying for, how much the beneficiary will receive and when etc.

How regulatory bodies and financial institutes fit in

From a regulatory perspective, Rubin shares:

- The need for tracking of cross-border payments, which is currently not happening

- Proper KYC procedures, while being simple and straightforward, should adhere to regulations

- Shinichiro adds that banks are an important piece of the puzzle for cross-border - to track, monitor, and control the flow of money.

- While there are several companies sharing data about credit underwriting, we do not have the same kind of information or even source of data for fraud in cross-border payments. A centralized system could be utilized.

- Takeshi adds that whitelisting cross-border payments could be beneficial, but it also brings in data security and privacy concerns for financial institutes to share cross-border data.

Conclusion

Ramesh concludes that awareness is the key to growing cross-border payments, to create confidence in the consumers. A lot of companies have built nimble products to enable cross-border, but a lot of consumers still look to banks or traditional financial institutes for this. Compliance is, of course, crucial and there is a lot of work needed to be done still.